Related:

Managing Domestic Labour in a Remote Workforce

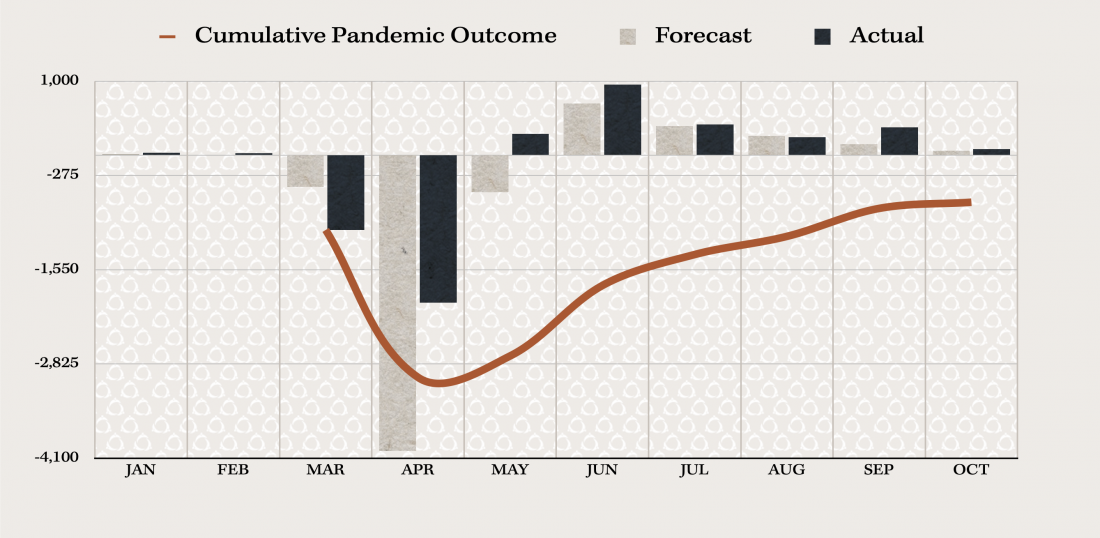

In October, Statscan’s employment change reflected an employment increase of only 0.5% totalling 84,000, bringing total employment to 18,554,000.[2] Accordingly, unemployment exceeded forecasts as it fell just slightly in October by -0.1% to a total of 8.9%. These numbers represent slower growth than that reported in September, where we were pleased to see job numbers exceed forecasts—but those increases of 2.1% in employment in a pandemic economy are not levels of recovery we should continue to expect.[1]

Within this tamped growth, employment saw a 1.5% increase in full time employment, down only 3.1% year over year compared with a decrease of 3.4% in part time work.

Since May, employment has climbed steadily at an average of 2.7% month over month. These numbers demonstrate a slow-and-steady economy which is not impervious to resurgences of the virus; this suggests we may see less part time job creation through the holiday season.

Employment Growth Largely Full Time Positions While Provinces Experience Widening Gap

Countrywide, employment prospects look very different. In British Columbia, hiring and corporate attitudes are optimistic; though the virus is seeing some resurgence, the populace and businesses, as yet, carry on. BC and Alberta both posted employment increases—1.4% and 1.1% respectively—in October.[2] “In BC, businesses avoided a total shutdown,” says Henry Goldbeck, President of Goldbeck Recruiting Inc.[3]

“Businesses have developed contingency plans and many are not going to give up without a fight,” says Goldbeck.

“As a result, we’re still seeing investment in the employment necessary to keep businesses healthy.”[3] Things are not so sunny toward the centre and easterly part of the country: both Ontario and Quebec are seeing sharp increases in COVID-19 cases and, as such, fears of locking down businesses loom large. This fear is exemplified by cities like Winnipeg, MB, which on November 2, 2020 was moved to a “Code Red” status, locking down all non-essential businesses and threatening thousands of jobs.[4] Ontario reported a modest increase, one lower than its average, in job numbers in October; Quebec gained no ground and unemployment edged up 0.3% to a total of 7.7%.[2]

Declines in employment were noted for the first time since May in hospitality and related industries, a worrying trend which we discussed in our September employment update. With “code red” statuses around the holidays, the sector may see heavy employment losses before this winter ends.

Regarding steady industry growth, enquiries for placements in construction and engineering crossed the desks of Goldbeck’s recruiters more than other sectors in September, reflecting a consistent interest in construction at commercial and civil levels.[3] However, in October, growth stalled, leaving construction employment within 7.5% of the pre-pandemic level. The surprising relative health of the construction industry is a trend which dates to the early days of the pandemic; but finding placements for expert and decision making roles remains challenging.[3] The number of job searchers in October rose by 3.5%, or 52,000.[2]

Despite recovery, cross-industry reticence is sustained: people are apprehensive to leave stable work for a new role, even when offered higher compensation or other benefits.[3] People also view bigger companies as more stable.[3]

However, “for those folks looking for work,” says Goldbeck, “we’re finding a lot of flexibility. People will take unideal roles or conditions over no work at all.”

This isn’t the opportunity employers may imagine, however. “When the economy picks back up, however, it will be a real challenge to keep those underemployed or undervalued employees happy. Businesses must balance current conditions with the realities of a recovered economy, which certainly includes heavy competition for high quality candidates.”[3]